Burvix Traders' affiliate program allows participants to earn passive income without direct trading investments, while the strategies have undergone back-testing to withstand any market movement by modeling opposing situations within the same timeframe. We will delve deeper into this and more in the second article dedicated to the Burvix Traders trading product.

In the previous text, we have already familiarized ourselves with the Burvix.io trading platform, payment for our services, and walked through the process of a client applying to connect a trading bot. Let's continue our exploration.

Types of Strategies

At the core of our trading bot lies algorithmic trading. We have chosen the Dollar-Cost Averaging (DCA) method. It involves the trader regularly purchasing a certain amount of assets to average the purchase price.

For example, let’s take the long strategy – a client’s investment in a stablecoin and trading in anticipation of growth. The deposit amount is divided into several parts-iterations for additional purchases at specific intervals in case of a decline. If the price rises, the bot executes buy and sell operations – we make a profit. If it falls, the bot buys into these parts-iterations of the traded token, thereby lowering the average price and threshold for profit, allowing us to profit during market corrections.

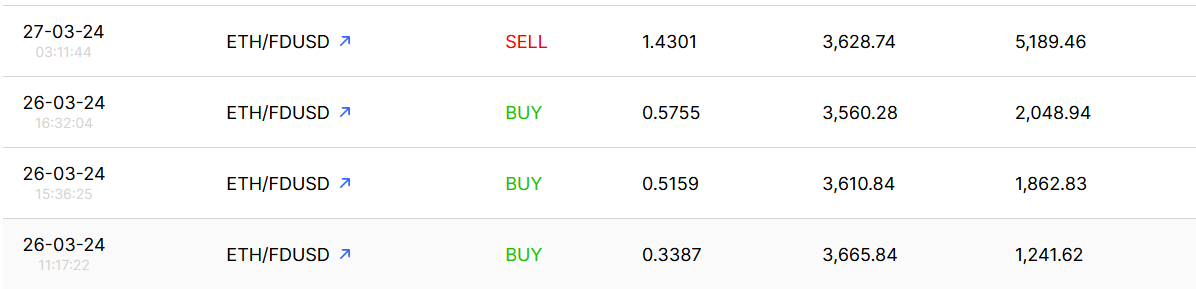

This example illustrates the essence of the strategy, which can be seen in the Orders History section when the trading bot is active on the Burvix.io portal. The first iteration of the bot was at a rate of 3,665. The market slightly decreased in price, resulting in two more iterations being purchased, the lower of which was at a rate of 3,560. During the market correction at a price of 3,628, the take-profit order was triggered, bringing profit to the client. Here we see how 3 iterations worked, but it should be understood that in planning our strategies, we rely on significantly higher figures – no less than 11, and more often 15-20 iterations at various drawdown levels. This allows us to withstand significant price fluctuations and generate profit.

Strategy Testing Methodology

Before offering trading in a specific trading pair to clients, each of our strategies undergoes key testing stages to ensure viability under various historical conditions.

Our first step is the initial selection of the trading token for stability, analyzing it for long-term potential and the risk of “scams.” If the token is deemed relatively reliable by us, the second step is to launch testing of the trading pair with this token using random parameters for each iteration. After obtaining results, we select the best-performing strategies from the obtained ones and refine each iteration using genetic methods to achieve an ideal balance between profitability and stability.

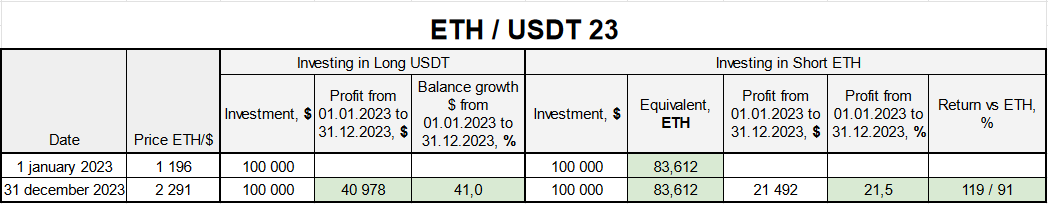

For a strategy to be deemed viable by us, it must demonstrate a positive outcome in both “long” and “short” types on a single timeframe. For example, let’s take the USDT/ETH pair tested on the 2023 timeframe.

Identical strategy settings yielded a 41% result for the long direction and 21.5% for the short direction. This discrepancy in figures is due to a significant increase in token price from October to December of the previous year. However, the strategy brought profit to the client regardless of the chosen direction, demonstrating its resilience.

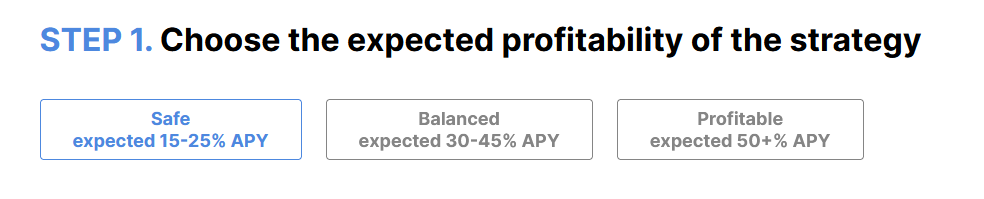

On the website, in the bot connection section, clients can choose strategies of different types.

The distinction between them is as follows:

- Safe strategies: Tested on a continuous period from 2021 to 2023, enduring all market situations and yielding profits in both directions.

- Balanced strategies: Tested on the 2023 period.

- Profitable strategies: Primarily composed of pairs with altcoins tested on the 2023 period. The use of such strategies, considering the high volatility and potential unreliability of altcoins, depends solely on the client’s preference.

Trading Risks

Risk management and the security of client assets are our top priorities. We do not engage in margin or futures markets, therefore, we do not use leverage and do not face position liquidation. As mentioned earlier, our strategies have undergone historical testing from 2021 to 2023 and are designed to withstand any market dynamics and consistently generate profits.

However, for each trading pair and strategy, we consider the event of a “Black Swan,” which refers to a sudden market surge (or decline, depending on the strategy’s direction) of 15-60% within a short period. The specific percentage varies depending on the characteristics of the trading token and the aggressiveness of the strategy. According to statistics, such events typically occur several times a year. Our trading strategies take this into account and are prepared for such situations.

In the event of a “Black Swan” situation, the following scenario unfolds: the entire balance transitions into the traded token. For instance, in the case of the USDT/ETH pair for long trading, the client’s entire deposit, initially in USDT, is converted into ETH, purchased at various intervals during the token’s price decline. Conversely, in the case of short trading, the balance shifts from ETH to USDT, acquired at different stages of the token’s price growth. During this time, there remains a single take-profit order. Once this order is executed, the bot resumes operation with the entire deposit, bringing profit to the client again.

In the event of a “Black Swan” situation, our recommendations to clients are as follows:

- Avoid making hasty decisions; do not let emotions override reason. Emotions are the primary cause of losses in trading. This is the problem our automated trading service using bots aims to address.

- Keep everything as it is. We are confident in our trading systems, and we believe that the market will rebound with profit, and trading will resume.

- If you find it challenging to manage your emotions and decide to halt trading, you can always reach out to our support team. We will assist you in closing your positions.

Burvix Traders Referral Program

Another way to earn passive income without directly investing in the bot’s operation is through our referral program.

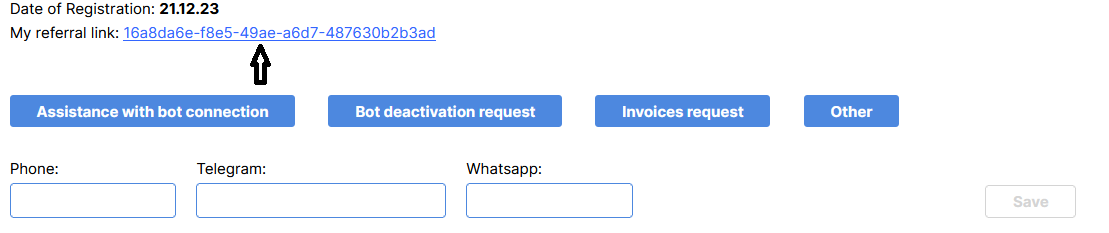

If a new user registers for our bot through your referral link, you will receive 10% of the total amount of all their paid invoices for the entire period of usage. Accumulated amounts will be automatically paid out once per quarter. To participate in our referral program, you need to create an account on the Burvix Traders platform and obtain your referral link in the Profile section.

Please note that the 10% referral commission of the total amount of all their paid invoices is the base rate and it can be increased on an individual basis if referred clients make deposits in trading exceeding 300,000 USDT or 5 BTC.

Conclusion

In these two articles of the series, we have covered all the key aspects of the Burvix Traders service. Please register on our website and explore the features of the internal cabinet. Remember, until you start earning profits, it’s all free, so we are interested in the success of your trading.

If you have any additional questions or need consultation, feel free to reach out to our Telegram support channel. We are always open for communication. We look forward to a new, mutually beneficial, and long-term cooperation!

photo source